News from "The Gouge"

Available here at "thedegouge.com"

January, 20 2022

Inflation and the Money Supply.

Inflation is here to say, says the money supply.

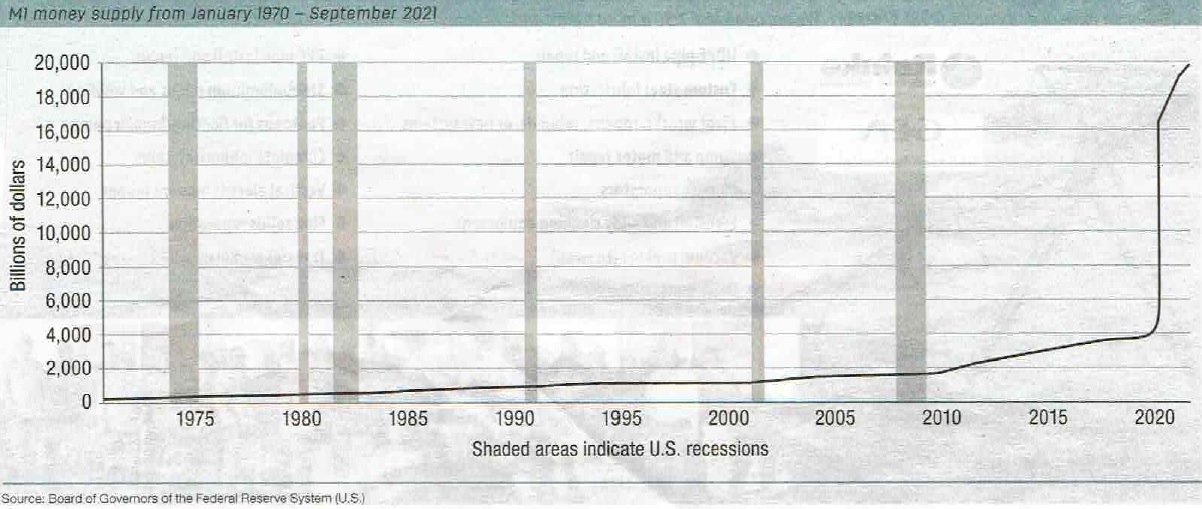

Supply and demand are essentially the fundamental basis of trade, hence the basis of value. As something becomes more available, it becomes less valuable.

For example, what is the value of sand? It is everywhere, so it has little value.

If money is printed in extreme quantities, then it looses value.

The US Money supply is increasing at a mathematically exponential rate. See the table below and ask yourself what will this do to the value of US dollars?

Is this transitionial? Temporary? Sustainable?

The US is days away from reaching the thirty trillion dollar national debt mark. That is $30,000,000,000,000.

Many nations have tried Modern Monetary Theory, there is nothing modern about it.

The ancient Romans, Chinese, Germans, and many more societies have all went through this practice of printing wealth.

All those examples enjoyed the temporary sugar high of free money, then societies had to go back to the gold standard.

How can you print this much money and not devalue it?

Knowing all of this, is it time to invest in something other than US dollars? Gold may be the answer, or real estate?

The alternative to knowledge and adaptation, in this case is slowly losing your savings value, as is occuring in Venezuela...

This release is for informational purpose only.

No legal, financial or investment advise is given, just opinion.

Learn more at thedegouge.com

Copyright 2021